1.

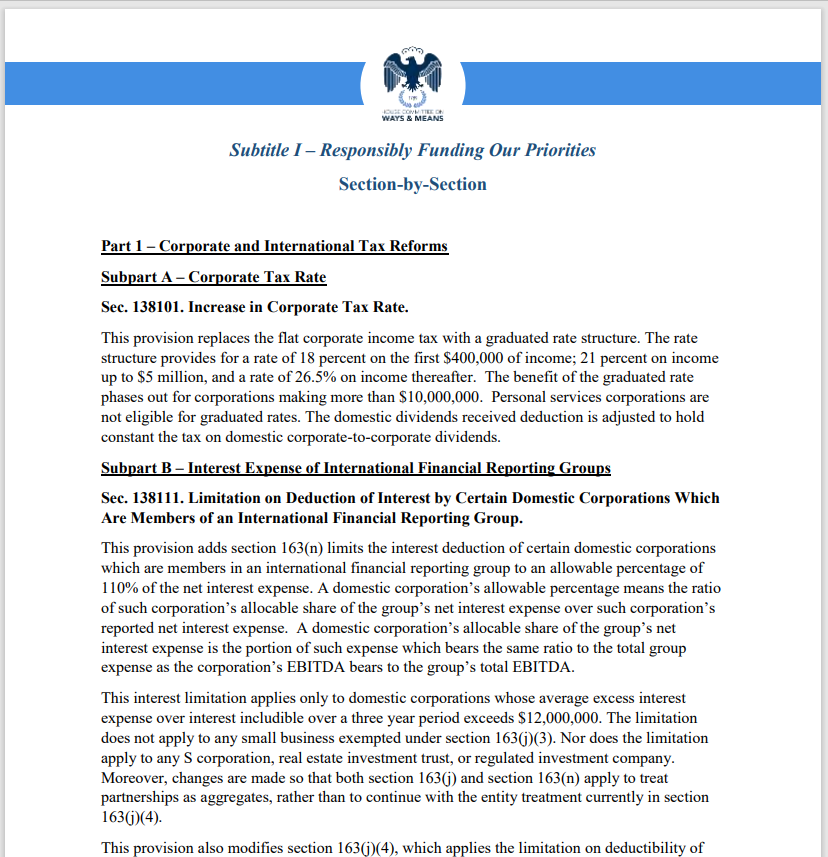

The Proposed Laws

1) No more investing in many PPMs, private investments, certain crowdfunding, certain crypto deals, etc. Investments open only to accredited or sophisticated investors (among others) are banned for IRAs, upon pain of death to the IRA.

More specifically, if the issuer of a security (e.g., shares in an LLC, corporation, trust, partnership, etc.) requires that the IRA owner represent that (s)he has a minimum amount of assets or income OR has completed a certain level of education OR holds a specific license or credential, then the investment is banned. If the IRA makes such an investment, it ceases to be an IRA, period. All of its funds become taxable as if distributed (creating a 50% to 60% tax hit on the IRA’s many assets) and are no longer tax-sheltered.

Such a ban would cut IRAs out of many, many private investments – most PPMs, some loans, many private deals, certain crypto arrangements, you name it. The idea is to force IRAs into tiny deals (e.g., buying a rental property without an LLC, at least until they ban that as well) or into Wall Street. Passive investment of IRA funds into private deals would become far, far less common. Your IRA would have far fewer investment options. And those who raise money from IRAs would have to seek funds elsewhere.

Your IRA has two (2) years to exit such investments – or face destruction. There is no grandfather clause. There is no penalty or tax abatement if “exiting the investment” involves an early distribution from your IRA. You may need to sell the once-legal investment at a fire sale price to meet the two-year deadline.

Why ban most private investment by IRAs? Why these harsh restrictions with draconian penalties? Why reduce retirement options in an uncertain world? Why cut an important source of funds for Main Street? Why force Main Street into Wall Street? It’s not because of Peter Thiel and it’s not to raise revenue. Why?

This section presently only applies to IRAs. It would take a stroke of a pen, now or in the future, for it to apply to 401(k)s, Solo 401(k)s, and other accounts. First, they came for the IRAs, and I did nothing since I did not have an IRA…. later on, they came for my 401(k) and who-knows-what-else. Even if you do not presently have an IRA, you have a dog in this fight.

2) Banning ownership by your IRA of more than 10% in ANYTHING. No more “Checkbook LLCs”, or IRA’s use of land trusts, or of personal property trusts. No more owning 10% or more of any entity by your IRA, including JVs (even handshake deals, which are considered “partnerships” under tax law), trusts, LLCs, blocker corporations, etc. In addition: Any personal ownership (direct or indirect) “counts” towards your IRA’s ownership. For example, if you (or your spouse, or other related persons) own 6% of an LLC, your IRA can own no more than 4%.

If your IRA, for example, wishes to own a rental property, that property must be owned directly by the IRA. LLCs for asset-protection would be banned. Similarly, if your IRA lends money, then it must do so directly in its name and not via a trust or LLC to preserve anonymity or provide asset protection.

Your IRA will no longer be permitted to do 50/50 JV deals (or any deal where the IRA owns more than 10% of the deal) with private persons.

Similar to Section 1: Your IRA has two (2) years to exit such investments – or face destruction. There is no grandfather clause. There is no penalty or tax abatement if “exiting the investment” involves an early distribution from your IRA. You may need to sell the once-legal investment at a fire sale price to meet the two-year deadline.

Why ban most private investment by IRAs? Why these harsh restrictions with draconian penalties? Why reduce retirement options in an uncertain world? Why cut an important source of funds for Main Street? Why force Main Street into Wall Street? It’s not because of Peter Thiel and it’s not to raise revenue. Why?

This section presently only applies to IRAs. It would take a stroke of a pen, now or in the future, for it to apply to 401(k)s, Solo 401(k)s, and other accounts. First, they came for the IRAs, and I did nothing since I did not have an IRA…. later on, they came for my 401(k) and who-knows-what-else. Even if you do not presently have an IRA, you have a dog in this fight.

3) No more IRA investing in any entity (e.g. even a “handshake JV”) in which you (or certain related persons) are directly or indirectly an officer or director. That would include a ban on Checkbook LLC’s/trusts and other entities (even if the IRA owns less than 10%) that you manage directly or indirectly (e.g. – through a nominee, figurehead, strawman, “financial friend”, etc.).

Similar to 2 & 3, above, you have two (2) years to exit the investment or your IRA dies.

Similar to 2 & 3 above, this proposed law would only apply to IRAs... for now.

Similar to 2 & 3 above, this harsh proposed law has nothing to do with solving The Peter Thiel Problem.

4) Roth Conversions Limited. This section certainly applies to IRAs. It may also apply to 401(k)s; the 401(k) language is very opaque & makes for very hard reading. I have not yet been able to get my arms completely around it.

This Section disallows conversions of After-Tax Traditional accounts to Roth. In other words, only pre-tax Traditional accounts may be converted to Roth, resulting in taxation of the conversion. Tax-free conversions to Roth from After-Tax accounts are banned. This effectively kills the “Back-Door Roth IRA” and possibly the “401(k) Mega Roth” techniques.

I’d get those Back-Door Roth IRA and “401(k) Mega Roth” conversions done before year-end, just in case. This part of the law takes effect in 2022.

5) $10M+ Retirement Plans Required to RMD Excess. To the extent an individual’s combined “Defined Contribution” Plans (IRAs, 401(k)s, etc., but not Defined Benefit Plans) exceed $10 million, that individual is required to distribute 50% of the excess. This requirement only applies in years where the individual’s income is greater than $400K (filing single) or $450K (filing joint).

For example, if one’s combined retirement plans (excluding defined benefit plans) equaled $11 million, then a distribution of $500,000 would be required if one made over $400K/$450K that year. The proposed law does waive the 10% early-distribution penalty.

Without going into details, when an individual’s combined retirement accounts (excluding defined-benefit plans) exceed $20 million, the required distributions would have to come from Roth accounts (at least to the extent needed to get the account balances under $20M).

Individuals whose account balances are $10M or more would not be permitted to contribute to IRAs.

It is adjusted for inflation (e.g. – the $10M will increase each year). The adjustment is probably based on the CPI which understates inflation. That’s not good if we arrive at a Zimbabwe-like day where $10M USD doesn’t mean much. As time permits, I will research and propose a better inflation index. Information as to how Congressional pensions are indexed would be useful; please send only definitive links and not guesses, as I lack the time to screen the latter.

This is the part of the proposed law that solves 99.98% of the Peter Thiel Problem. The complex & extensive existing rules (e.g.- Prohibited Transactions, UBIT, Excess Contributions, etc.) are more than sufficient to prevent widespread abuse of the $10M in permitted accumulation. That is especially true if the IRS gets a massive amount of money thrown at it, as proposed elsewhere in the bill. The IRS needs to do its job instead of lobbying to ban self-directed investing (which it has done since 2009 to make its task easier instead of completing its task).

I think this part of the law is going to pass no matter what; indeed, I rather “get it”. The key is two-fold: To get rid of the extra, very harmful & unnecessary provisions and to get this $10M cap properly indexed for inflation.

6) Existing Statute of Limitations Codified. Quoted directly from the Congressional “summary”:

“Sec. 138313. Statute of Limitations with Respect to IRA Noncompliance. The bill expands the statute of limitations for IRA noncompliance related to valuation-related misreporting and prohibited transactions from 3 years to 6 years to help IRS pursue these violations that may have originated outside the current statute’s 3-year window. This provision applies to taxes to which the current 3-year period ends after December 31, 2021.”

This portion of the Congressional summary was actually pretty accurate. It merely formalizes the statute of limitations already found in the case law. Be aware of the “valuation” language. Best to keep your valuations (and anything else you report to the IRS) honest, and promptly file the tax returns that start the statute of limitations (e.g., Form 1040 for IRAs, including children’s’ IRAs), Form 5500 for 401(k)s, and Form 990-T for UBIT). I have no major objection to this provision. Note: Most IRA prohibited transactions already had a 6-year statute of limitations attached to them. The valuation portion is new – and understandable given that negligence & abuse are pretty common in that regard.

7) Codification of IRA Owners Being Treated as Disqualified Persons for Prohibited Transaction Purposes. Quoted directly from the Congressional summary: “Sec. 138315. IRA Owners Treated as Disqualified Persons for Purposes of Prohibited Transactions Rules. The bill clarifies that, for purposes of applying the prohibited transaction rules with respect to an IRA, the IRA owner (including an individual who inherits an IRA as beneficiary after the IRA owner’s death) is always a disqualified person. This section applies to transactions occurring after December 31, 2021.”

Just a codification of existing case law. No objection here.